Network tokenization without the hassle

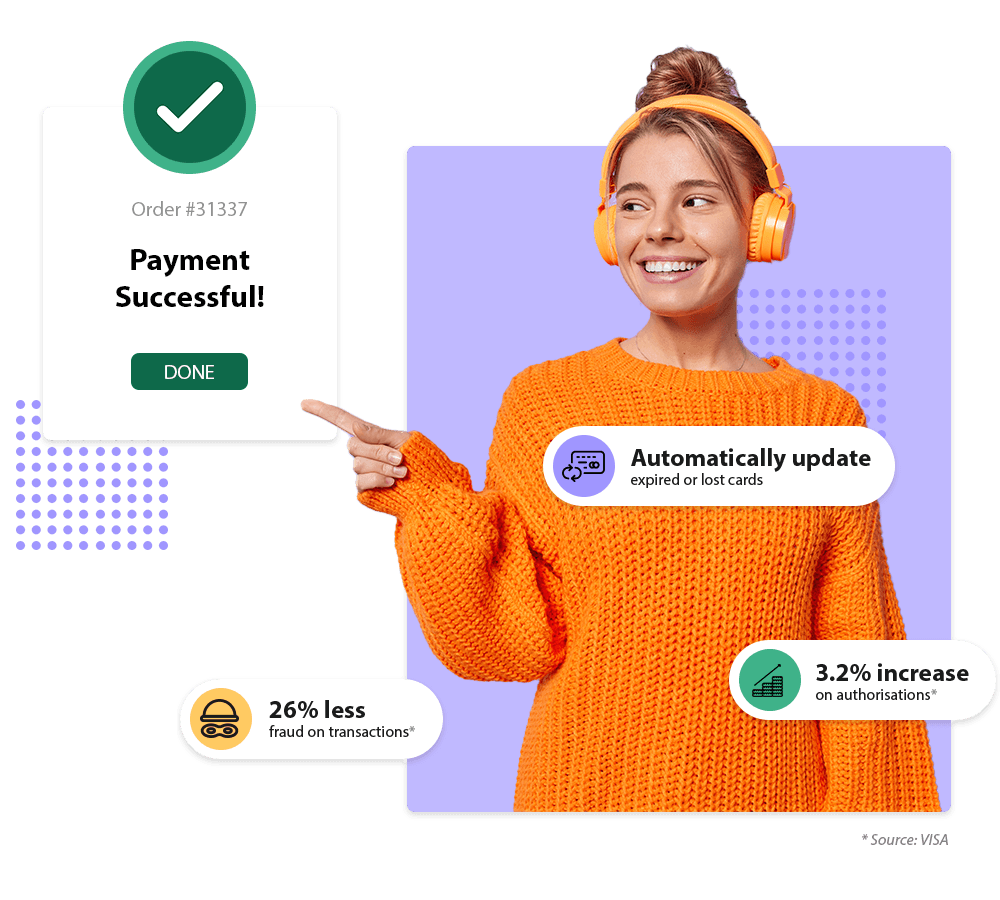

Network Tokenization makes payments simple and secure

In an era where convenience and security are paramount, the future of online payments has arrived, and it's called Network Tokenization. It not only simplifies the payment process but also ensures your financial transactions are more secure than ever before.

The industry foresees a liability shift with card-not-present network tokenization. Merchants usually cover fraud charges, but the trend is moving the liability to issuers, much like card-present EMV transactions.

It also comes with lots of additional benefits. It eliminates the inconvenience of dealing with expired cards because network tokens never expire. They automatically renew when the cardholder receives a new card.

Additionally, it enhances acceptance rates by providing unique tokens for each merchant and customer. This uniqueness significantly reduces the risk of credit card fraud and data theft, giving issuers more confidence in approving transactions.

Moreover, Network Tokenization has led to a significant reduction in interchange fees for card-not-present transactions.

Learn more about Network Tokenization

We want to make network tokenization available to everyone

Our mission is to democratize network tokenization, making it accessible to businesses of all sizes. We're here to help you save valuable time and resources, with a streamlined approach that ensures a faster time-to-market and lower starting costs.

Our cost-effective pricing plans result in lower monthly and yearly fees, making our solution more affordable than traditional methods.

Flexibility is at the heart of our service. Our risk-free approach allows you to make changes at any time, ensuring your payment solution remains aligned with your evolving needs. You have the freedom to switch to another provider or integrate directly with card schemes without long-term commitments.

Our easy implementation process simplifies the integration to card schemes. Powered by our unified API, you can quickly and smoothly integrate our solutions into your systems, minimizing the hassle and maximizing convenience.

See the benefits of using Cardtokens.io

Our solution is uniquely tailored to cater to the needs of these industries

Acquirers

We transform Acquirers payment processing, by reducing complexities, and elevating their role in the payment ecosystem.

Payment Service Providers (PSPs)

Our solution equips PSPs with the tools they need to simplify payment processes and offer top-tier services to their clients.

Merchants

We help merchants adapt, thrive, and provide a seamless payment experience to their customers while optimizing their costsGot cards that are not supporting tokenization? No problem

Is your business dependent on recurring payments or subscriptions, and do you have cards that don't support tokenization? No problem. Our Account Updater service is here to ensure that your customers' payment details stay up to date, no matter the circumstances.

The Account Updater is a valuable tool for businesses that rely on ongoing payments. When changes occur in a customer's credit card information due to factors like card expiration or card replacement, our Account Updater service comes to the rescue.

It proactively identifies outdated card data and automatically replaces it with the most current information, including the new card number, expiration date, and security code.

This approach minimizes payment declines, ensuring seamless billing and reducing customer disruptions. In turn, it boosts your revenue and enhances customer satisfaction by keeping payment information up-to-date.

Learn more about an Account Updater